This is from 2024 | 5 minute read

Dark Patterns Are Immoral and Illegal

Quickbooks is using dark practices to trick people into using a paid Payments product, and I'm out $1486.25.

Rather than burying the lede, here's the crux of it:

This forced overlay appears when you try to send an invoice. The interstitial scrolls, automatically, past the fees. One signs up inadvertantly, a client pays a giant bill with a credit card, and I pay ~4% on their payment. That's a dark pattern, it's illegal in California (where Intuit is incorporated), and it's a gross design and business practice.

Here's the longer version.

A few days ago, I logged into Quickbooks to do some bookkeeping. I found a charge for $598, from Quickbooks. I've been paying them $31/month for far too long, but I’ve never paid them something like this. I looked back in my list of charges, and sure enough—there were more charges like this, for a total of $1486, each named “System-recorded fee for QuickBooks Payments. Fee-name: DiscountRateFee, fee-type: Daily.”

I tried a number of different things to figure out what it was, including calling, and after blowing about an hour or so on a Sunday, I got to this:

Trisha Maan Grace at 6:26 PM said

Thank you so much for patiently waiting and I do appreciate that you contacted us first regarding this matter. However, upon checking here in my end, as much as I want and love to help you, this is already out of our scope. But no worries here's the phone number of the dedicated department that caters your concern 877.556.4407 , please give them a ca ll to assist you immediately. I don't want to take too much of your time, so I'll be ending the chat now, Thank you for being the most cooperative customer. Again, Thank you for contacting Intuit QuickBooks Online Support. Stay safe and have a good day!

Trisha Maan Grace has left the chat, 6:26 PM

This was sort of the icing on the cake, so I took to LinkedIn to rage-post.

And because I had a friend at Quickbooks, my post got forwarded around, and I received an email from someone in the “Office of the President” named Joey. (If you don't happen to have a friend at Quickbooks, and would like to get in touch with the “Office of the President”, you can email oopescalations@intuit.com.) His initial email informed me that

…to have a merchant account approved you must enter the information needed for an account ie. social, date of birth, business information, and banking information. Upon doing so there will be an option with a link to the terms of service you can click on. By saying you wish to continue to be able to accept payments, this is agreeing to those terms of service which will be included below.

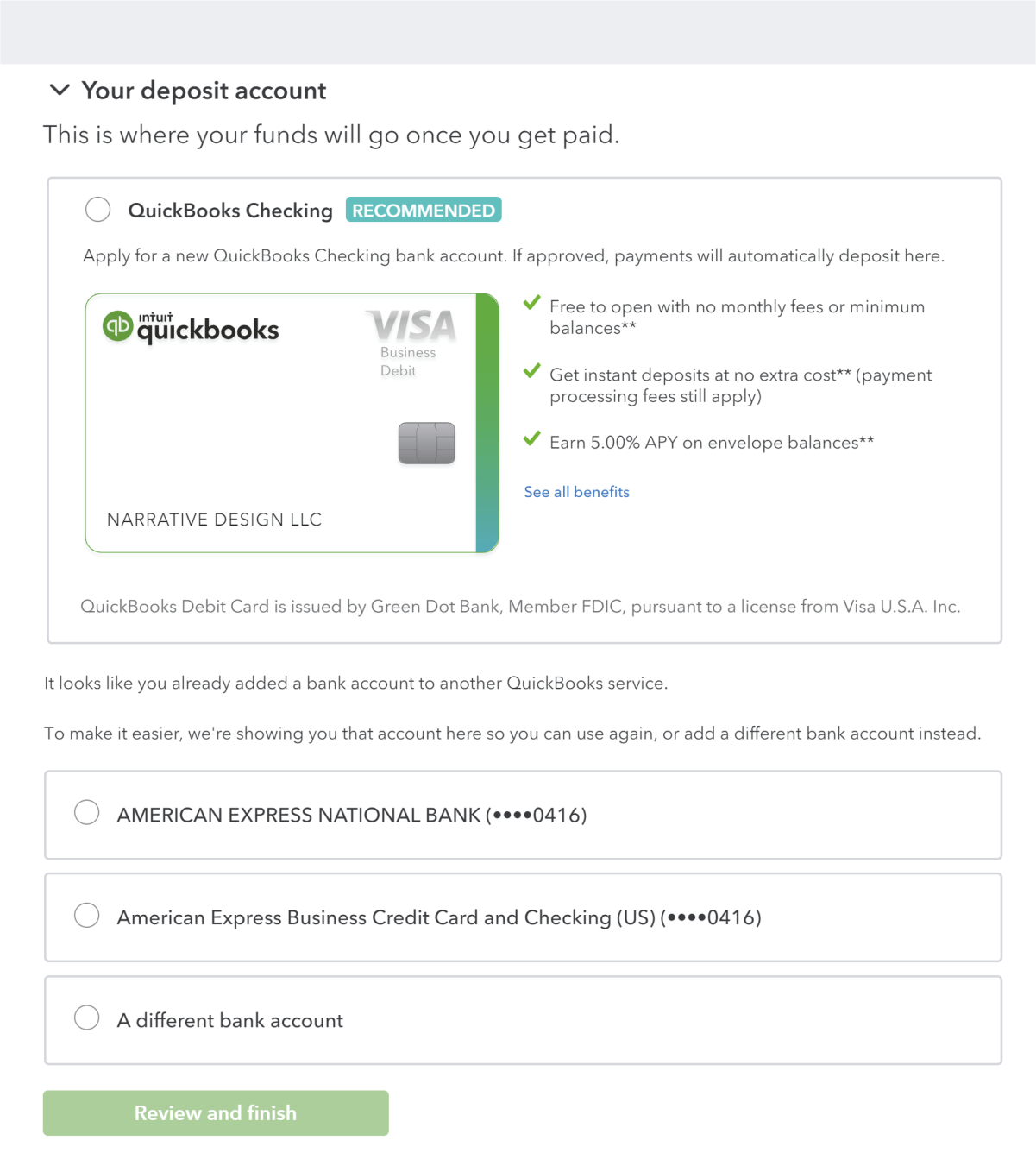

Above is the screen he was describing. First, the page gives me an advertisement for another paid service called Quickbooks Checking. Then, it asks me about my bank. There’s nothing else on the page.

But—if you click on the two asterisks next to the indication that there are no fees, the page suddenly shows new content at the bottom; under the header Features, it explains that there is a 1% fee (Note that I was charged much more than that.)

There is no “Agree to Terms of Service” indicator of any kind.

I’ve been taking payments from my customers for years. Why, I mused to myself, would I want to take credit card payments on deals that are in the tens and hundreds of thousands of dollars? The answer is, of course, I don't, and there's no way I ever signed up for such an account. Joey couldn't produce any real documentation that I actually agreed to terms of service, and so I'm committed to disputing the charge with AmEx.

It never ends...

This morning I logged into Quickbooks to invoice a customer. Upon starting the invoice, our friendly full-page, auto-scrolling interstitial shows back up, taking over my invoicing process. I had turned off the Payments product, yet here it was again. In the context of a flow where I was asking my clients for money, sure, I want to accept payments. I started to get an idea of what happened.

I decided to do some sleuthing around. I already have a distaste in my mouth for Quickbooks, using it only because my accountant asked me to; it's become a plague of endless in-product advertisements for services I don't want. I had an inclination that they had done something to get me to sign up for Payments “by mistake.”

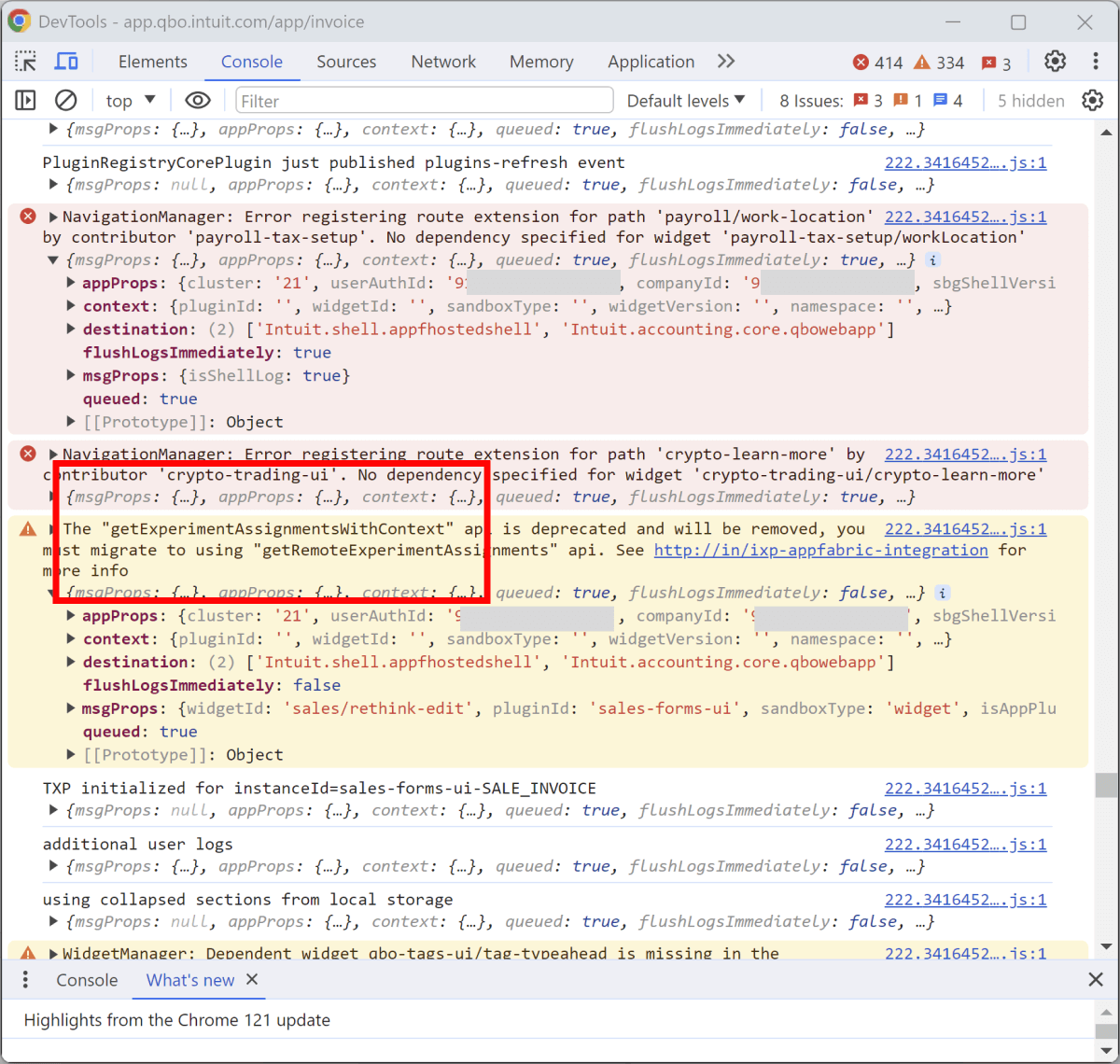

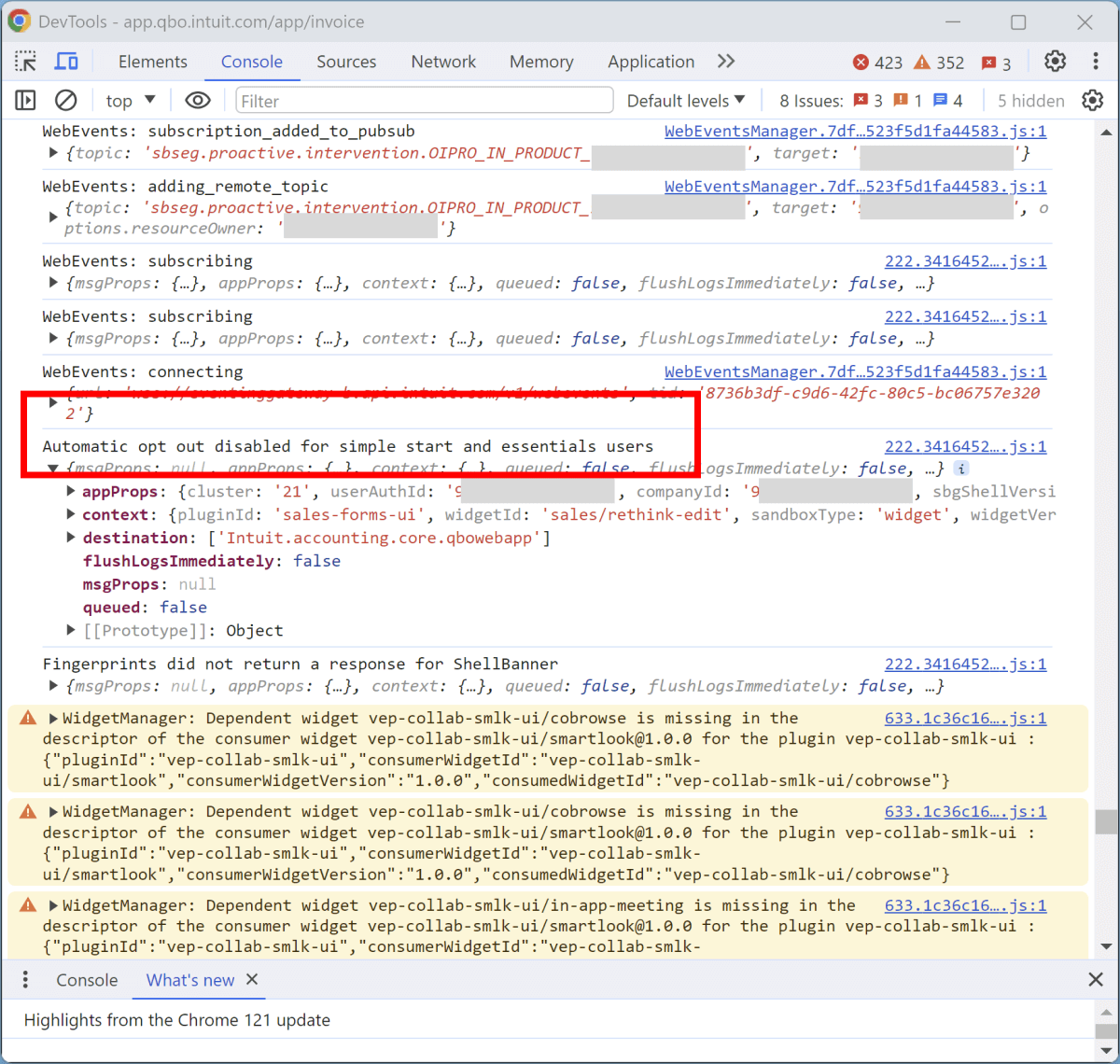

I opened the console, refreshed the page, and watched. Thanks for leaving your development logging on, dev team!

It looks like they’re A/B testing the obnoxious interstitial to see how many people they trick:

And, since I'm on the cheapest Quickbooks plan I can get, I'm in the "No, you can't opt out" part of the Payments advertising flow.

Since it looks like the Payments team has infected most of the company, I decided to see if it’s extended into other parts of my experience. I decided to see what invoices look like for my customers.

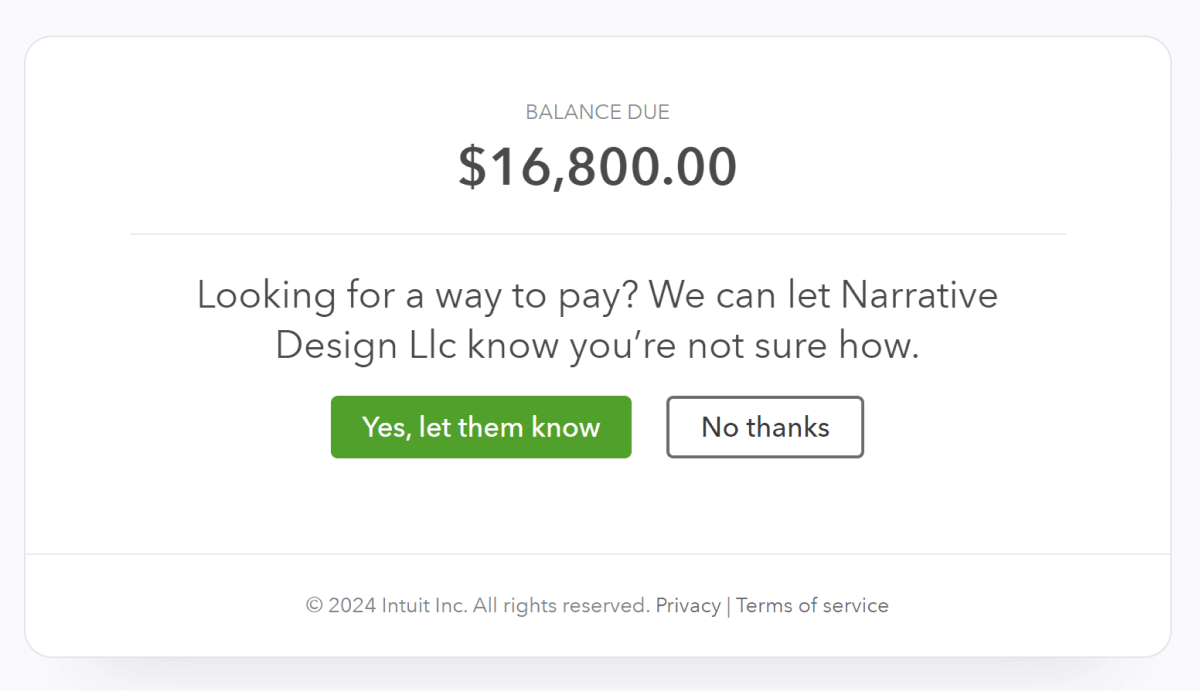

I clicked to view the invoice that I just sent, and I saw this:

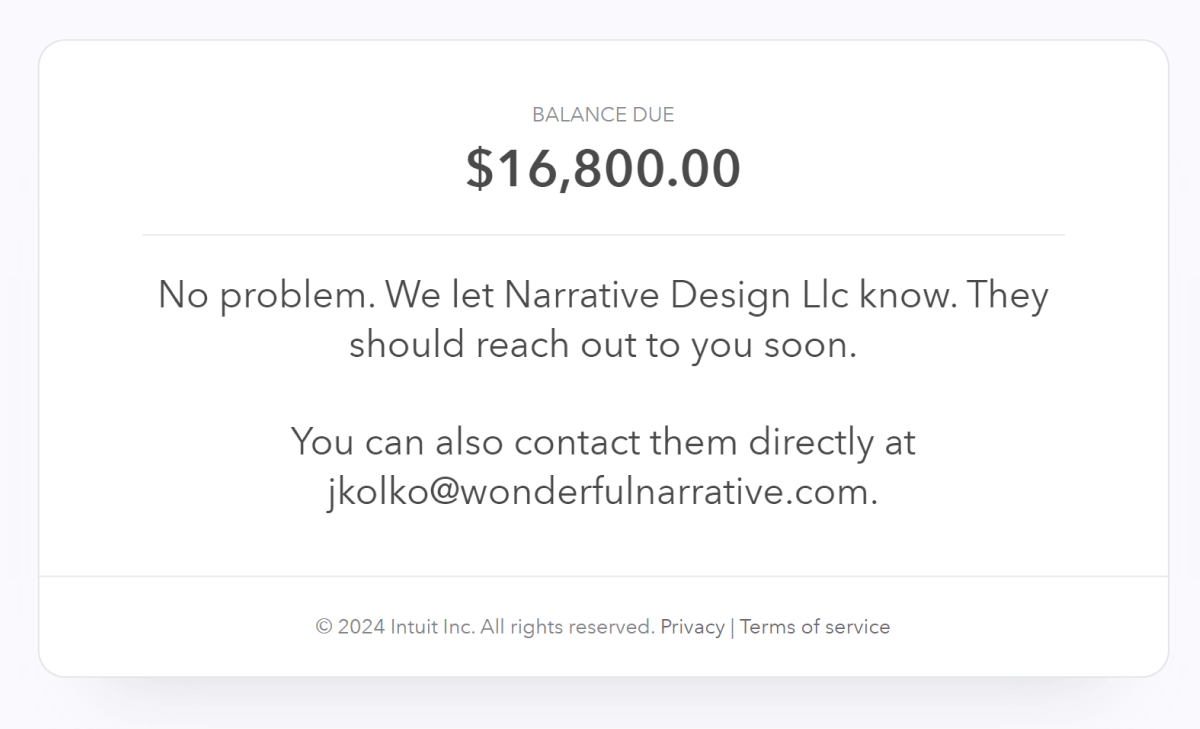

A call to action, to call me to action? I wondered what would happen if I clicked the email.

Looks like it dispatched an email to me. What does it say?

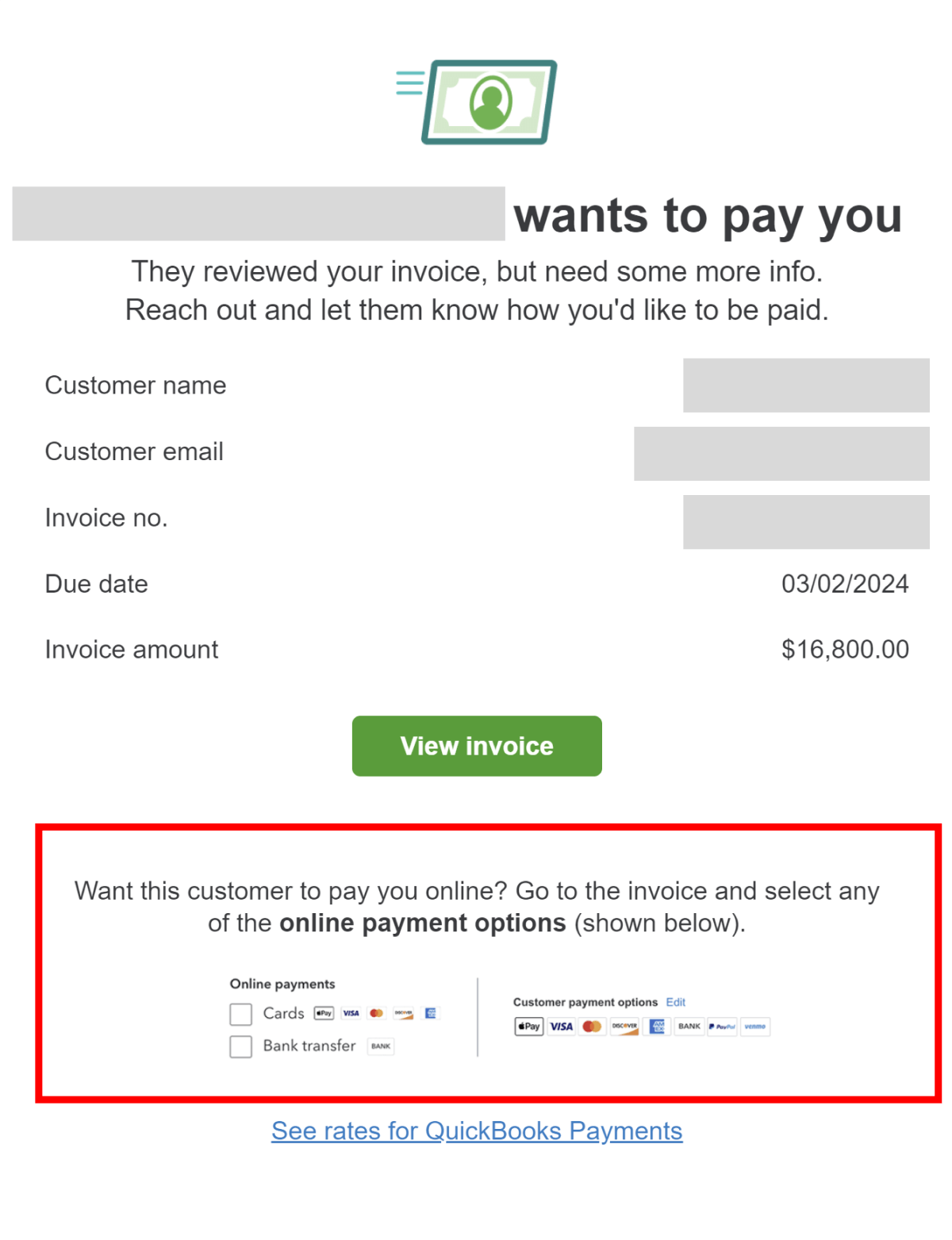

Why, it's an ad for Quickbooks Payment, which—when clicked— loads—you guessed it—our scrolling interstitial.

Finally, I looked at the invoices my customers had paid via credit card. There's no indication on the payments, at all, that money is being skimmed off their payments.

This is a shameful, purposeful business process.

Everything that happened to me is by design. Trash customer service, hidden charges, products that are presented at the moment I'm most susceptible to a lack of critical thinking or thoughtful attention switching, trusted-source referrals sent unbeknownst to the sender, a lack of in-context details about what charges are being applied, and—of course—the auto-scrolling, full-screen takeover, are all on purpose. They were thought-up, designed, coded, and approved by all sorts of levels of management.

These practices are, also, illegal in California, Colorado, and Connecticut, with pending laws and conversation in Illinois, Delaware, Pennsylvania, Massachusetts, and New Jersey. Laws against patterns like this will soon be aggressively enforced in the EU, through the Digital Services Act.

The worst part of all of this: I can't get away from Intuit, because my accountant needs me to use Quickbooks.

If you worked on this at Intuit, in any capacity, you should probably take a long look at what you’re doing with yourself.

And if you use Quickbooks, go check your account. I bet you have charges for services you didn’t want, and that you were tricked into buying.

Update February 9, 2024:

My case was escalated, and my money was returned. The representative I spoke with told me that the development team takes these sorts of things seriously, and I can expect to see changes in the future. The dark patterns on the site haven't changed.

Update March 17, 2024:

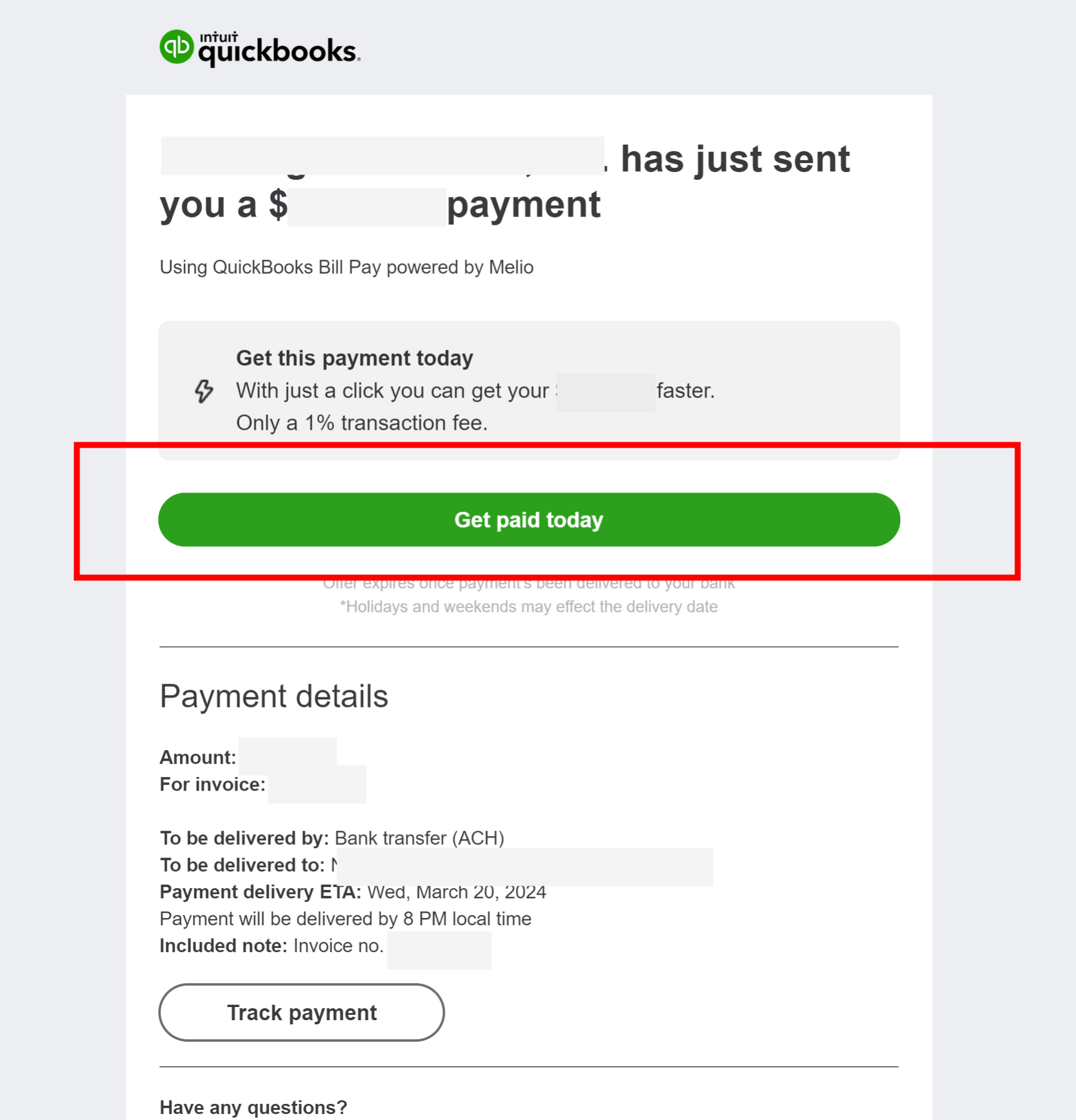

Today, I received an email, explaining that I could Accept Payments Online, with a big green button to get paid today:

Of course, clicking the big green button takes you to a screen with another big green button where, you guessed it, you turn on Payments, again. Quite a commitment to change.

Originally posted on Feb 1, 2024. Updated February 9, 2024; Mar 17, 2024.